Why hire a property Manager

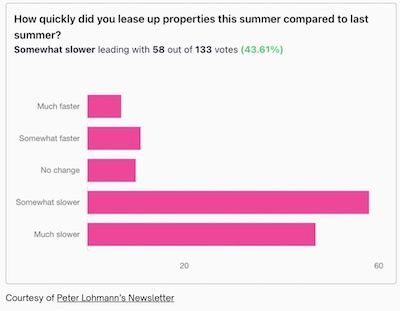

Over the past 3–6 months, the rental market in Orange County and across the country has slowed in a measurable and meaningful way. According to the Rent Engine Q3 2025 Leasing Data & Trends Report, 79% of property managers reported a slowdown in summer leasing compared to last year—a sharp shift from the rapid activity we saw in 2024.

This cooling trend means one thing for owners: pricing correctly from Day One has never been more important.

The First 7 Days Still Make or Break Your Outcome

Even in a slower market, renter behavior hasn’t changed. The report shows that almost 40% of all renter leads arrive in the first seven days of marketing. After Day 7, lead volume drops off sharply, and by Day 10+, listings enter a long, slow “lead tail” with much lower engagement.

In a fast market, an overpriced listing might still get lucky. In today’s slower conditions, it won’t. There’s no surplus of renters to fill the gap created by incorrect pricing.

Overpricing Now Carries an Even Higher Cost

With demand softening, overpriced listings are getting punished faster. Rent Engine’s data shows:

- Overpriced homes typically start 5% above market

- They require 2+ price reductions

- That results in 11+ extra days on market

- Which costs owners $750–$760 in lost rent on an average property

These numbers were concerning last year. Today—when leasing velocity is down—they’re even more impactful. Every additional day vacant costs more because it takes longer to regain momentum once a listing falls behind.

Leasing Has Slowed Quarter Over Quarter

The report shows a clear pattern across 2025:

- Q2 saw a major drop in leads and showings, hitting the lowest conversion rates of the year

- Q3 rebounded slightly, but activity still trails the pace of 2024.

This slowdown reveals that many owners entered the summer expecting a hot leasing season and priced accordingly. The result was a wave of mid-summer price corrections—many happening too late to prevent prolonged vacancies.

Orange County Benchmark: 14–21 Days on Market

While the national average sits at 26.8 DOM, well-priced Orange County rentals continue to perform better, typically leasing within 14–21 days. Homes that fail to secure interest in that window almost always share one factor: incorrect initial pricing.

The Bottom Line

In a slower market, everything depends on Day One:

- Correct pricing captures the early surge of qualified renters

- Strong first-week activity prevents vacancy loss

- Proper positioning avoids wasted time, unnecessary reductions, and tenant fatigue

The data is clear. The market has shifted, renter activity has softened, and pricing discipline is now the difference between a quick placement and a drawn-out vacancy. In today’s slower climate, getting the price right upfront is the strongest competitive advantage an owner can have.